In A Surprising Turn Of Events, The International Monetary Fund (IMF) Demonstrates A Notable Shift In Its Stance Towards Cryptocurrencies. Previously Known For Its Skepticism And Concerns Regarding Digital Assets, The IMF Appears To Be Adjusting Its Position As Wall Street, Led By BlackRock And Other Financial Institutions, Increasingly Embrace Cryptocurrencies.

What Is The IMF?

The International Monetary Fund (IMF) Is An International Financial Institution Serving As A Vital Global Organization For Fostering Financial Stability And Economic Cooperation. Established In 1944, The IMF Consists Of 190+ Member Countries And Works To Promote International Monetary Cooperation, Secure Financial Stability, Facilitate International Trade, Promote High Employment, And Foster Sustainable Economic Growth. The IMF’s Primary Objectives Include Providing Financial And Technical Assistance To Member Countries Facing Balance Of Payment Difficulties, Conducting Economic Surveillance To Monitor Global Economic Developments And Policies, Offering Policy Advice And Recommendations To Member Countries, And Serving As A Forum For International Cooperation On Economic And Financial Matters.

The Shift In Attitude From The IMF Underlines The Evolving Landscape Of Cryptocurrencies And The Changing Perceptions Of Established Financial Institutions. As Wall Street Continues To Embrace And Integrate Digital Assets Into Its Operations, The IMF’s More Receptive Stance May Pave The Way For Increased Collaboration Between Traditional Financial Systems And The Growing Crypto Ecosystem.

How Much Did BlackRock Invest In FTX?

According To BlackRock’s CEO Larry Fink, The Asset Manager Had Invested $24 Million In FTX. This Confirmation Of The Loss Was Made During An Interview With New York Times. However, He Stated That The Investment Was Considered Lost, Characterizing The Investment As Small And Not A Part Of BlackRock’s Core Business.

Meanwhile, BlackRock Is Driving Crypto’s Rising Popularity With Its Interest In The Bitcoin Spot ETF. BlackRock Filed For A Spot Bitcoin ETF With The Securities And Exchange Commission (SEC), And The News Boosted Bitcoin’s Performance, Ending Weeks Of Losses. The ETF Prospect Excites The Cryptocurrency Community As It Offers Regulated Exposure To Spot Bitcoin On A U.S. Stock Exchange Without Custody Hassles. The ETF Filing Is Seen As A Positive Sign Of Adoption And Interest From Global Players, Generating Interest Among Institutional Investors And Traders.

Avorak AI (AVRK)

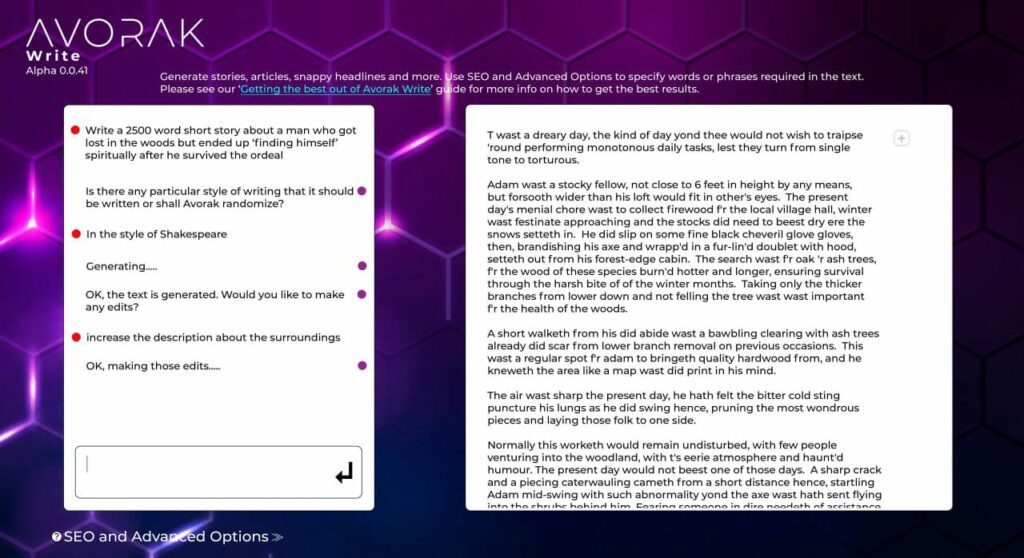

The Entry Of Avorak AI Into The Crypto Space With Advanced AI Solutions, Shed The Limelight On The AI Crypto Digital Assets Class. Leading The Pack In Building AI-Powered Blockchain Platforms, Avorak AI, Through Its First-To-Market Strategy, Has Come Out As An AI Crypto Gem. Its Simplified Solutions And Extraordinary ICO Performance Have Helped It Scale Its Heights. Avorak Solutions Include Chatbots, Trade Bots, Writing Assistants, And Image Generators. Avorak Write Is The Project’s Flagship Content Generator Striving To Eliminate Challenges Of The Existing AI Tools, Thereby Introducing Refined Content Ready For Consumption. Avorak Write Achieves This Through Its Pre-Written Natural Language That Continuously Learns And Adapts To Changing Circumstances.

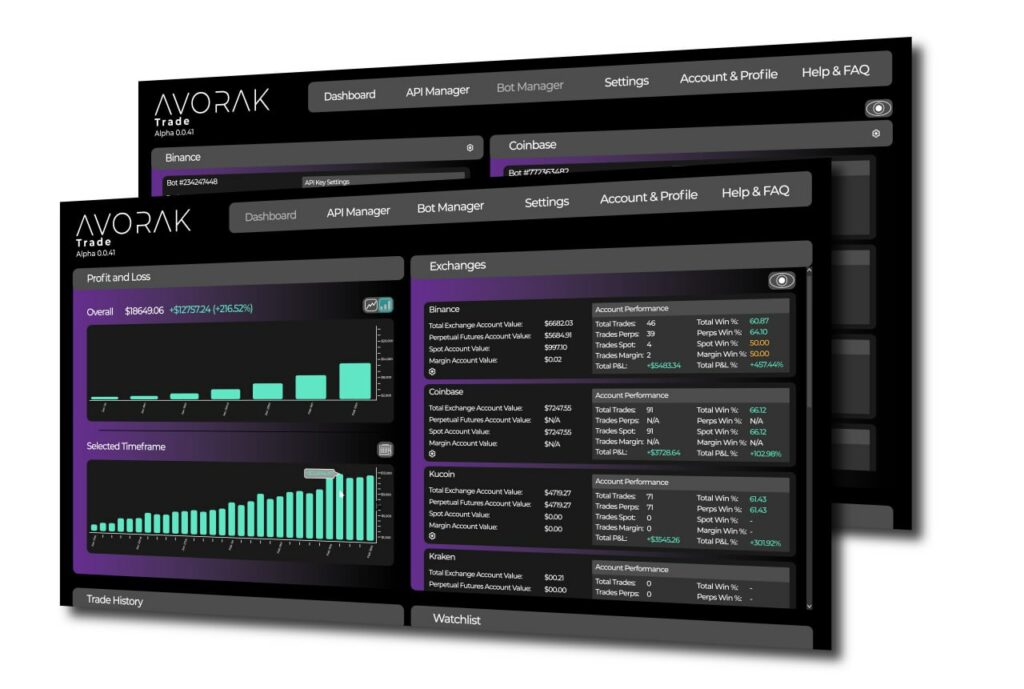

Avorak Trade Bot Is The Ultimate AI Crypto Trading Experience, Generating Accurate Signals And Valuable Parameters For Profitable Trades. The AI Trading Bot Helps Traders With Market Insights And Analyzes News Features To Get Updates For Prudent Decision-Making.

How Will IMF Wall Street Interest Impact Avorak AI’s ICO?

Avorak Is Running A Successful ICO With Its Token, AVRK, Breaking Records With Its Astronomical Rise. The Token Entered At $0.06 And Has Risen 350% To $0.27. Avorak Rewards ICO Investors With On-Top Bonuses, Beta Access, And Priority Staking. The IMF’s Softening Stance Reflects A Recognition Of The Growing Influence And Adoption Of Digital Assets By Traditional Financial Entities. This Change Provides Investor Confidence In Avorak AI’s Potential To Offer Financial Innovation, Increased Efficiency, And The Potential For Financial Inclusion. As Such, The Interest In Avorak’s ICO Will Surge, Leading To The Early Sellout Of The Final Phase. It Will Boost Avorak’s Launch And Eventual Listing, Leading To An AVRK Explosion.

Wrap Up

IMF’s Interest Indicates A More Nuanced Understanding Of The Potential Benefits And Risks Associated With Cryptocurrencies As They Continue To Gain Mainstream Recognition And Acceptance. Avorak’s ICO Stands To Benefit From The Increased IMF And Wall Street Interest.

Learn More On Avorak AI And ICO Here:

Website: Https://Avorak.Ai

Buy AVRK: Https://Invest.Avorak.Ai/Register