This is an important moment worth remembering. On January 11th, Beijing time, Gary Gensler, Chairman of the US Securities and Exchange Commission, announced a major decision by the US SEC to approve 11 exchange traded funds (ETFs) listed in the United States that track Bitcoin.

This decision marks the official entry of Bitcoin into the mainstream financial market, providing investors with a new investment tool.

I. A Ten-year Tug of War Over Approval

The SEC’s approval of the Bitcoin ETF this time marks a formal shift in the attitude of regulatory agencies towards cryptocurrencies such as Bitcoin.

According to the official website of the US Securities and Exchange Commission, applications from companies such as BlackRock, Ark Invest, 21Shares, Fidelity, Jingshun, and VanEck have been approved.

Among them, the application submitted by BlackRock has sparked competition from other institutions, leading to other companies submitting applications one after another.

Previously, due to the growing demand for cryptocurrencies in the market, asset management giant BlackRock submitted an application, and multiple institutions were also preparing to launch Bitcoin exchange traded funds.

Source: sec.gov

For a long time, regulatory authorities have been cautious about the volatility and potential fraud in the crypto market. Cameron and Tyler Winklevoss brothers applied to launch the Winklevoss Bitcoin Trust Fund as early as July 1, 2013, when the price of Bitcoin was less than $100. Afterward, the US Securities and Exchange Commission rejected more than 30 similar applications, citing that these products were susceptible to market manipulation. This decision has sparked widespread controversy and criticism.

According to statistics, the number of crypto ETF applications submitted to the SEC has been continuously increasing in the past few years.

According to data, as of now, over 500 institutional investors and 1,000 individual investors worldwide have applied to invest in Bitcoin ETFs, indicating that investor interest in Bitcoin is continuing to grow.

In addition, according to research institutions, the global crypto market has reached trillions of dollars, with Bitcoin accounting for about half of the market share.

II. Industry Outlook After ETF Approval

Overall, the recognition of mainstream institutions will undoubtedly bring more funds to the crypto market, which may intuitively reflect the continuous improvement of market value. At the same time, crypto technology will also be more integrated with practical applications, and is expected to attract more regulatory attention, bringing opportunities and challenges to the industry.

The inflow of institutional funds: According to institutional forecasts, with the approval of the SEC, approximately $200 billion of institutional funds will Flow into the Bitcoin market. This will have a positive impact on the price of Bitcoin and increase market stability and liquidity. In addition, the participation of institutional investors will help reduce market volatility and speculative behavior, and improve market maturity.

Enhancing Bitcoin’s recognition: This decision will enhance Bitcoin’s recognition in society and the financial sector. More people may begin to realize that Bitcoin is not only an investment tool, but also a means of value storage and payment, which is expected to promote the application of Bitcoin and other cryptocurrencies in daily transactions and commercial activities.

Competition and regulation: As more funds and attention enter the crypto market, regulatory efforts and industry competition will also intensify. Major exchanges and financial institutions may launch more products and services related to cryptocurrencies to meet market demand. At the same time, regulatory agencies may strengthen market supervision to ensure the protection of investor rights. This will help reduce fraud and manipulation in the market, improve transparency and fairness, and may also constrain the innovation boundaries of the industry, narrowing the excess market opportunities during the wilderness period.

III. Outlook for the Future Market of Coin Prices

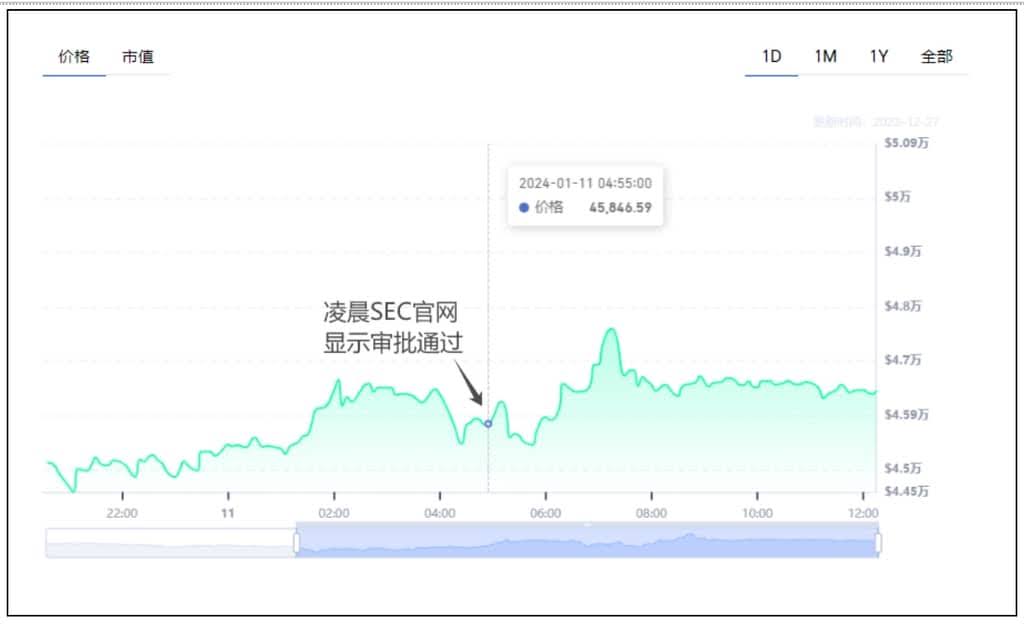

It is worth pondering that after the approval news was announced, the price of Bitcoin did not fluctuate dramatically, which may be due to the recent proliferation of various true and false news, leading to a cautious pace in the market.

But then the price of Bitcoin for school uniforms climbed to over $47,000. At the same time, the market quickly shifted its direction and began to speculate on the approval of spot Ethereum ETFs. Ethereum prices also saw a significant increase, with an increase of 11% and breaking through the $2500 mark for the first time, which is a phenomenon that has not been seen in 20 months.

Source: Gate.io

Source: Gate.io

It is worth noting that although the SEC has approved the first spot Bitcoin ETF, past application history shows that not all crypto ETFs have been approved smoothly. According to data, only about 30% of crypto ETF applications submitted to the SEC in the past few years have been approved.

Moreover, after being converted to POS, Ethereum has acquired certain characteristics of securities. Although it was previously considered a commodity by the CFTC, the official SEC statement has never confirmed this. Rather than saying that the market started hyping up Ethereum ETFs, it is more accurate to say that after the landing of Bitcoin ETFs, market funds began to “sell facts” and turned to hype up the Cancun upgrade and its Ethereum series.

In addition, even with SEC approval, Bitcoin ETFs still face other challenges. For example, some market participants may question the trading mechanism and liquidity of Bitcoin ETFs. Regulatory authorities may remain vigilant about issues such as market manipulation and risk management.

Overall, the approval of the US spot Bitcoin ETF is an important milestone, marking the gradual recognition of the crypto market by mainstream society. The success of Bitcoin ETFs still needs to be verified in practice. Next, Bitcoin will face a market game of internal fourth halving and external Fed rate cuts, and investors still need to be cautious and aware of potential risks. I believe that in the future, with the advancement of technology and the improvement of regulatory systems, the crypto market is expected to usher in a more prosperous and stable period.